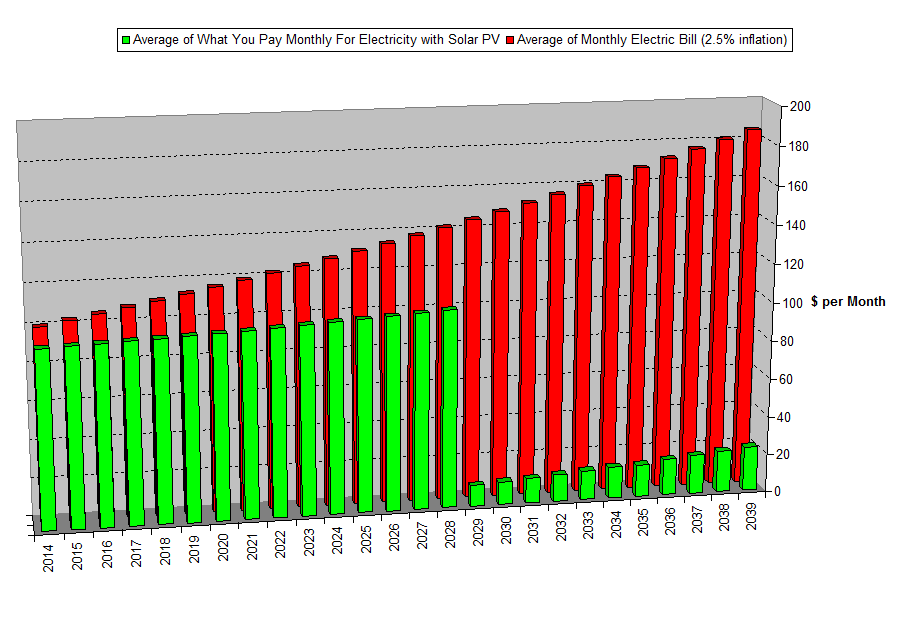

Here is graphical example of how much money can be saved by installing a grid-tie PV system. This particular example uses a 15yr energy improvement loan to finance the system. It takes into account the 30% federal tax credit, as well as the Vermont SSREIP rebate. This model also takes into account a degrade in the systems efficiency. The first fifteen years, the owner's electricity bill is substituted for the loan payment, which is smaller than the original utillity bill, and from then on the solar array provides nearly free electricity. The system performance degrade is reflected in the relatively small bill that remains, and even this can be eliminated if we design our system a little bigger. It is important to remember that if your system is installed later in the year, you will likely still have an electric bill through the winter months, as most utility account credit building happens in the over production months of the summer. As well, the Federal Personal Tax Credit will happen when you file your taxes for the year the install was completed, and not instantly. These and other factors need to be considered when you finance your project. The picture below only serves as an example.